Lifecycles are for Everyone

Yes, even your dysfunctional organization.

One of the things I find interesting about marketing technology is how often the way we label or name something within a tool or platform can later influence how we use that language amongst ourselves later. “Campaign” is a great example of this—depending on what software you’re using, the book you’re reading, or the class you’re taking, the word can refer to pretty different behaviors.

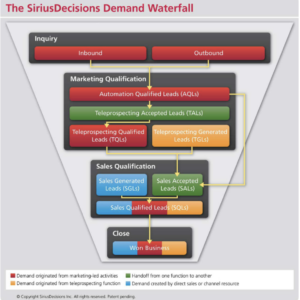

However, “campaigns are understood differently” is well-known in marketing technology. What about more in-depth marketing technology terms? Another term I’ve seen confused quite a bit recently is “Lead Lifecycle.” I’ve never been a fan of that exact term and usually prefer to use terms like “Customer Journey” or “Buyer Journey” instead. Why? Because there’s a strange correlation in the world of B2B marketing: equating “Lead Lifecycle” with “the SiriusDecisions Demand Waterfall.”

If this image looks like most lifecycles or customer journeys you’ve seen, that’s not a surprise. Around the time marketing automation platforms started taking a serious look at customer journeys, the “demand waterfall” model became more popular as a way to map business handoff. However, for many companies, that waterfall path doesn’t map onto their business model. That doesn’t mean they shouldn’t pursue mapping a journey—it just means they will need to think about things a little differently.

At the end of the day, a Customer Journey/Lead Lifecycle is a time-based measurement method for larger outcomes between your audience and your organization. In a previous article, I wrote about rethinking marketing campaigns to measure both the individual’s outcome and the company’s outcome for that initiative. Journeys take the next step and ask when and where someone is at to achieve the larger outcome. I doubt your marketing plan is “just send one email to someone and never engage with them again,” so gaining a broader understanding of when and where people interact with your organization is important.

Instead of thinking about the SiriusDecisions waterfall, I’d encourage you to think about your journey as a trail with multiple remote cameras set up along the main path of the trail. As a person passes through, their motion sets off a recording to show they were at a certain part of the trail at a certain point in time. That recording can then be analyzed later to give context to campaign performance and measurement.

(If only measuring journeys were that straightforward and didn’t involve people wandering off the trail half the time.)

Because journeys are unique to each organization, different points along the path need to be measured uniquely. Let’s look at some different ways we’ve set up journeys over the years at DemandLab—because not every organization fits the SiriusDecisions model—and how you can incorporate these same ideas in your journey measurement.

Company A: Measuring Within Marketing

Company A is representative of several companies we’ve worked with over the years—they recognized the need for a customer journey but were stuck with the limitations of an organization that wasn’t ready for marketing and sales alignment. Often, the biggest barrier to digital transformation is a lack of resources and prioritization from within an organization.

When this occurs, it doesn’t mean you shouldn’t have a journey; instead, think of the journey as a trail where only a few remote cameras have night vision. You can see some movement with the cameras that can see in the dark, but you may not be able to see what’s happening in front of or behind those parts of the trail.

Sometimes, all you can see is what your marketing team can control, and that’s OK. When marketers can’t find traction with organization-wide initiatives like a customer journey, a great way to start or accelerate conversation is to adopt journey measurement within a department. Marketing often has its own key performance indicators around the journey, such as lead generation, nurturing, and handoff to other departments. By focusing on these milestones and measuring the time it takes for prospects to achieve them, marketing departments start to get real performance data—and the ability to benchmark longer-term effects of campaigns. Being able to report on these metrics can also act as a catalyst for other departments to get involved in measuring their performance.

Lesson: When it comes to journey measurement, don’t let perfect be the enemy of good enough. If your organization is slow to change, look at what’s within the control of your marketing department, and start to measure parts of the journey that you lead. This has the immediate benefit of gathering marketing performance data and can encourage other groups to get on board with organization-wide transformation.

Company B: A Product-Led Growth Journey

Company B has a variety of offerings that can be purchased through traditional sales channels, but they ran into a problem when they launched a new SaaS subscription with a 30-day free trial. When Company B wanted to measure the effectiveness of this new model, they were stumped—the subscription model didn’t map onto their existing sales structure at all!

PLG, or product-led growth, models don’t map neatly onto traditional marketing and sales processes; rather, it is your prospects themselves who are doing all the qualification—from their end. As a result, the SiriusDecisions waterfall doesn’t accurately apply.

In this case, the company realized that these journeys needed to be measured differently until late in their traditional sales process. The resulting journey, when mapped out, looked like a broom: many different bristles/paths leading to one handle/combined destination. The reason for splitting the two? Marketing and sales needed to provide each path with different customer experiences. If a customer has already qualified themselves for interest, marketing’s focus is no longer on qualification or excitement: it’s ensuring product activation to make it “stickier” for the prospect. Once the person purchases the product, there’s also different behavior from sales. A customer who can cancel a month-to-month subscription is sold differently than a customer with a locked-in, multi-year contract.

Lesson: By modeling two paths separately–and letting them overlap where it mattered for revenue–Company B was able to avoid having one-size-fits-all measurement skew and tailored their organization’s responses to the unique differences in their selling models. As more companies diversify their offerings, these complex paths will become more common for innovative organizations.

Company C: Adding Other Departments to Measure

Company C is a high-growth organization with a startup mentality—but its products tend to be purchased primarily in the first quarter of the year. As a result, the company cares about measuring its ongoing cash flow in addition to whatever deals its sales team is closing in a quarter. Therefore, they have a unique setup: when an opportunity is considered “Closed Won,” they do not actually close the opportunity. Rather, they mark the opportunity as Open with a 99% probability.

When their customers complete the procurement process and cash is realized, it is only then that the next steps in their journey—onboarding, customer marketing, and account retention—start to take effect. By preventing these steps until revenue is realized, the company can accurately understand the headcount for customer enablement throughout the year, preventing budget problems and seasonal fluctuations.

Lesson: When a customer journey is mapped across an organization, it’s not just sales and marketing that benefit from the measurement. Having additional departments integrate their processes with what’s being measured can provide unexpected benefits to the company. As you plan your strategy for benchmarking a customer journey, try to get the opinions and involvement of as many departments and functions within your organization. You never know what problems you may be solving as a side effect of your efforts.

Company D: Multi-MAP Measurement

Large-scale enterprises often have complex solution sales processes that span multiple divisions. In these organizations, cross-selling and upselling opportunities are equally important as bringing in new customers. Company D has several different CRMs and MAPs (marketing automation platforms) deployed across their enterprise, each focusing on a specific division or business unit and the prospects and customers key to each.

However, it’s common for many of Company D’s customers to purchase products and services across multiple divisions—and corporate initiatives pushed their marketing department to deploy a complex cross-selling process across the different MAPs. Each division had a customer journey at the time, but it acted in isolation to take someone from a prospect to a new customer only. As a result, they ran into a major issue: how do you track multiple divisions selling to large customers at different points in the customer journey?

The answer: rather than try to re-architect the enterprise to support one centralized lifecycle, have the journeys interact and keep in sync with each other in the upsell/cross-sell process.

By synchronizing and aligning measurements between the multiple platforms, Company D got the best of both worlds: they could look at not only the customer journey for each division but could see the overall lifecycle throughout the enterprise divisions as a whole.

Lesson: Tools like marketing automation platforms are built with certain types of customers in mind—but enterprises generally don’t fit the mold of a typical company. Out-of-the-box solutions for customer journey measurement may not fit your business’ needs. Rather than letting the marketing automation platform dictate how the enterprise should measure its complex customer journey, Company D started with business priorities and worked to make its systems meet those requirements. The same concept applies regardless of your organization’s scale.

(Also, if setting up a complex, multi-system lifecycle sounds like something you can’t do, I heard a certain consultancy created one in less than two months.)

Company E: The Higher Ed Experience

Sometimes, a sale is clear: you buy one of a few options. When it comes to purchasing a college education, though, it takes more work. Company E, a liberal arts college, shows the different types of complexities that can arise: with new students, returning students, transfer students, and alumni as possible prospects, how do you accurately track the application and enrollment process? Since higher education offers many different programs and areas of interest, how do you measure movement and interest? With different departments receiving different funds for their academic programs, having accurate data to see marketing impact is key.

Higher education also works differently than most businesses:

- There are B2B complexities like a long sales cycle, high price, and a buying team with many influencers

- There are B2C complexities such as brand awareness driving the top of the funnel, a high volume of customers, and a need to do advanced segmentation

- There are governmental complexities, like being reliant on public funding

This sort of selling model, much like the product-lead growth issues of Company B, doesn’t map cleanly onto existing marketing automation concepts. To make the concept work, Company E focused heavily on discovery and making sure technological processes directly followed people-driven processes rather than the other way around. As Company E progressed in developing its measurement, it used each opportunity when data that went awry or didn’t behave as expected as the potential to expand and improve its processes.

The final Customer Journey created for Company E was heavily modified from standard B2B lifecycle models to accommodate the college’s processes for handling students. Some of the unique features this measurement took include:

- Measuring both an academic “Area of Interest” (such as “Business”) and “Program of Interest” (such as “Bachelor’s in International Business”) as their own custom objects that interface with the Customer Journey.

- Monitoring multiple opportunities throughout the journey: for example, it’s common to have students apply to multiple degree programs before choosing one final option.

- Having a “cycle of lifecycles”: since higher education requires you to measure both performance of a current term and upcoming academic terms, the journey for each is measured separately; as terms rollover (such as Fall -> Spring), the corresponding upcoming term journey data is moved to the current term, and a new “upcoming term” lifecycle begins again.

Lesson: Complex behaviors, especially those where people may be part of multiple customer journeys at the same time, can—and should!—be tracked as part of your company’s efforts. However, they may require some creative thinking and configuring things differently to meet your company’s person-driven processes.

(Anyway, I heard some marketing consultancy won an award for customer journeys in higher ed.)

Company F: Flip the Funnel on its Head

Until now, every company we’ve discussed in this article has been selling something to an audience. What happens when your organization doesn’t sell anything at all? Do you still need a customer journey?

Of course.

Company F is a unique organization: they don’t “sell” things in a traditional sense. As a private equity firm, the main focus of Company F’s journey is figuring out what prospects to invest in as portfolio companies. In order to best measure the experience they offer to their prospects and analyze their steps in evaluating potential prospects for funding, they use a customer journey model.

In order for Company F to get revenue, they need to qualify the companies they choose to invest in. The same ideas that other companies have when measuring their performance—lead generation, account qualification, nurturing interest, and relationship development—all still matter. Therefore, their customer journey is “flipped”; rather than a sale indicating ultimate success, it’s selecting companies that will provide the greatest return on their investment.

Lesson: It doesn’t matter what your company’s outcome is when it comes to your prospects’ journey; there are universal ways to measure success. They may not directly map onto “this is a sales opportunity,” but there will still be relevant milestones to measure time and progression.

To think about it another way: if you are a company that sells equipment to hospitals, there will only be so many hospitals. You will not be able to “generate new leads” beyond new hospitals being built or changes in hospital personnel. That doesn’t mean that sort of company doesn’t do lead gen campaigns; they just happen to know every potential lead ahead of time. Measurement is still a valid concept.

In conclusion, it is vital to recognize that there are numerous avenues to construct a customer journey, each tailored to suit the unique needs and objectives of your business. Don’t be confined by rigid templates or preconceived notions of what a customer journey should look like. Instead, empower yourself to design a journey that aligns with your business’ people-powered processes and is flexible enough to handle all types of journeys, fostering long-lasting relationships and driving business growth.

Furthermore, to measure the effectiveness of your customer journey, it is essential not to let tools dictate how you evaluate your progress. While analytics platforms and metrics provide valuable insights, they should not limit your ability to assess and track the success of your journey in a way that makes sense for your business. Customize your measurement framework to capture the unique aspects of your customer interactions and align them with your specific goals. Additionally, remember that time is a crucial element for measuring the performance of your marketing department. By tracking and analyzing data over different time periods, you can identify trends, measure the impact of your strategies, and make data-driven decisions to continuously improve and optimize your marketing efforts. Embrace a holistic approach that combines qualitative and quantitative data to gain a comprehensive understanding of your customers’ journey and drive meaningful results for your organization.

To learn more about how DemandLab can help, contact us.